Say hello to the all-new

Customers Bank Credit Cards

Pre-qualify

Pre-qualify

Answer a few quick questions to see if you pre-qualify without impacting your credit score.2

Apply

Apply

If you pre-qualify, complete your application and we will match you with the card that best fits your credit profile. Subject to credit approval.

Accept your offer

Accept your offer

Instantly accept your offer in the app and add your card to Apple/Google Wallet.

Fast. Digital.

Contactless.

It’s more than a credit card,

it’s an experience.

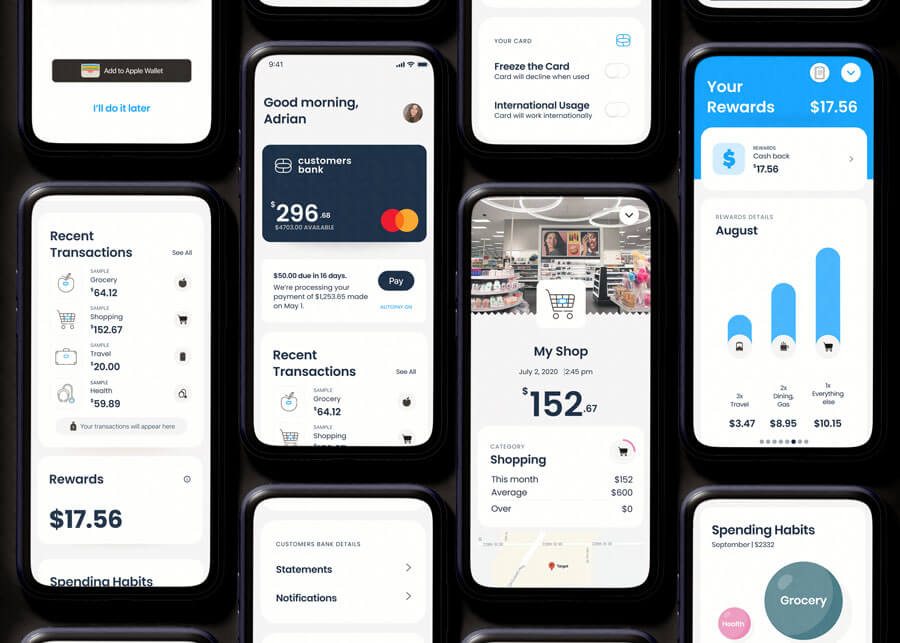

Screenshots are for illustrative purposes only.

See if you pre-qualify without impacting your credit score.2

See if you are pre-qualified

in as little as five minutes

Benefits

Make sense of the mess

Understand when and what you spend your money on

Earn unlimited rewards

Level up as you spend and earn more rewards with every purchase

Be on top of your financial game

Set up auto-pay and build credit

Keep your hard earned money

No annual fee

An added layer of protection

ID Theft Protection

More ways to pay

Use Apple Pay®, Google Pay™ and Samsung Pay

|

|

|

Customers Bank World Mastercard® |

Customers Bank Mastercard® |

|

| Cash back | ||

|---|---|---|

| 3% on Travel 2% on dining and gas 1% on everything else |

Cash back |

1% on every purchase |

| Unlimited Rewards | ||

| Yes |

Unlimited Rewards |

Yes |

| Annual fee | ||

| $0 |

Annual fee |

$0 |

| APR Ranges Rates and fees |

||

| Prime + 11.49% – Prime + 21.49% |

APR RangesRatesand fees |

Prime + 11.49% – Prime + 21.49% |

| Other benefit | ||

| Mastercard World Benefits |

Other benefit |

Mastercard Benefits |

| Choose between cash back and crypto rewards | ||

We’ll consider your eligibility for the cards above.

Frequently asked questions

Your Customers Bank Credit Card rewards will accrue when your purchase transactions post to your account. Your account must be in good standing; you may not receive Rewards during any time in which you are delinquent in making payments on your Card Account, or during which your Card Account is not in good standing. See Customers Bank Credit Card Rewards Agreement for more detail.

-

3% Rewards on all eligible purchases in the travel merchant category. This equates to $0.03 in Rewards for each $1 spent.

-

2% Rewards on all eligible purchases in the dining and gas merchant categories. This equates to $0.02 in Rewards for each $1 spent.

-

1% Rewards on all eligible purchases in merchant categories other than travel, dining, and gas. This equates to $0.01 in Rewards for each $1 spent.

There are two kinds of inquiries (or sometimes referred to as “pulls”) that can occur on your credit report: “hard” inquiries and “soft” inquiries. While both types of credit inquiries enable a third party, such as you or a lender, to view the information in your credit report, only hard inquiries may impact your credit score.

Soft inquiry typically occurs when a person or company checks your credit report as part of a background check or to make an offer of credit. A soft inquiry may be recorded in your credit report, depending on the credit bureau, but it does not affect your credit score. A soft credit inquiry occurs when you initially request a rate based on your name, address, and date of birth to determine your rate and eligibility.

Hard inquiries generally occur when a financial institution, such as a lender or credit card issuer, checks your credit report when making a credit decision. Hard inquiries might lower your credit score and they may remain on your credit report for two years. With Customers Bank, a hard pull occurs after you accept a credit card offer and complete the online application.

Card products are generated based on your creditworthiness. If you are eligible, you will be offered the card product for which you best qualify based on your credit qualifications.

A soft credit inquiry is performed at the pre-qualification phase of your application with no impact to your credit score. If you do not qualify, no hard pull will occur. If you pre-qualify and proceed with your application, a hard pull will occur at the time of approval, which may impact your credit score.

Be on top of your financial game and start earning rewards with a Customers Bank Mastercard®

Call us at 866-405-0824 with any questions.

Coming soon!

1 View Customers Bank Mastercard Terms and Conditions and complete list of rates and fees for more information.

2 This initial (soft) inquiry will not affect your credit score. Not everyone will qualify.

‡When you check your rate, we check your credit report. This initial soft (inquiry) will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information will be reported to the credit bureaus.

§While this link will take you to a section of the third party’s site which we manage, there are other areas of the site beyond our control. Aside from what is presented specifically on our pages, we do not accept responsibility for products or services offered on this third party’s site nor does Customers Bank necessarily support or condone any opinions or comments expressed or shared on this third party site that are not explicitly our own. Furthermore, as our own privacy policy and security policy are not applicable to this third party, we encourage you to seek out and read their policies.

To check the rates, card product and terms you qualify for (pre-qualification), Customers Bank conducts a soft credit pull with no impact to your credit score. If you choose to continue your application, we will request your full credit report from one or more consumer reporting agencies, which is a hard credit pull that may affect your credit. After evaluating your completed application request and credit report we may decline to offer you credit.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Play logo are trademarks of Google Inc.

Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

Terms and Conditions Apply. Customers Bank reserves the right to modify or discontinue products at any time without notice. Qualification for Customers Bank card products include the borrower must be a U.S. citizen or permanent resident in an eligible state and meet Customers Bank’s underwriting requirements. Not all borrowers receive the lowest rate. To qualify for the lowest rate, you must have a responsible financial history and meet other conditions for approval such as income and other factors. The rate you are approved for will be provided during the application process and is determined by eligibility, with Rates and Terms subject to change at any time without notice, and is subject to state restrictions.

Customers Bank Credit Mastercard® is issued by Customer Bank pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Images and related information featured are for illustrative use only.

Third party data, messaging and internet service provider fees may apply.