Personal Savings

Our new Yield Shield Savings Account automatically adjusts with the Federal Funds Rate* – so you get a rate that’s up to date. It’s easier to manage-no need to constantly check rates-and easy to open.

Open your account today.

denotes a required field

denotes a required field

Start earning

5.14% APY*

$25,000 minimum to open

This rate will adjust to always be the midpoint of Fed Funds Target Range minus 0.25% which is currently 5.39% – 0.25% for an APY* of 5.14%.

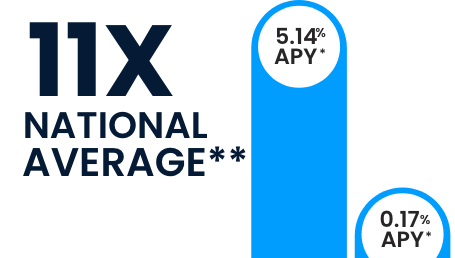

Earn 11x the national average savings rate.

With an open and funded Customers Bank Yield Shield account, earn 5.14% APY*.

**11x based on the FDIC monthly savings rate as of January 4, 2024.

Open

in minutes

$25,000

minimumto open

FDIC

insuredFrequently asked questions

The federal funds rate, or Fed rate, is the interest rate that U.S. banks (like Customers Bank) pay one another to borrow or loan money overnight. It also affects interest rates on consumer products like credit cards or mortgages.

To access your funds, visit www.customersbank.com and click "Log In" on the top right corner of the page. Enter the username and password you created for online banking.

The Annual Percentage Yield (APY) reflects the interest rate and the effect of the frequency of interest compounding (for example, daily) during a 365-day period. The Interest Rate is the annualized rate applied to the principal balance of the account each day in order to determine the amount of interest that has accrued on that day’s principal balance.

There are several ways to fund your new savings account. You may:

- Transfer money from your account at another bank.

- Choose a transfer of up to $50,000 for a one-time initial funding transfer during the account opening process. Keep in mind that this type of transfer will not be available for withdrawal for 10 business days from the transfer receipt date.

- If you have an existing account with Customers Bank you may transfer funds from that account to your Customers Bank savings account.

- Customers Bank routing number is 031302971. Refer to your account disclosures for complete terms and conditions.

Minimum deposit and balance to earn stated APY is $25,000.

* Annual Percentage Yield (APY) as of 1/19/2024. This is a variable rate. $25,000 balance required to open the account and to earn APY. APY and APR will follow Fed rate decisions within 48 hours. The rate will be the midpoint of Fed Funds Target Range minus 0.25% which is currently 5.39% – 0.25% for an APY of 5.14%. Applicable for consumers only. Fees could reduce earnings on the account. Offer may be withdrawn at any time. Debit card and checks are not available on this account. Available online only. For FDIC insurance information, visit FDIC.gov

§While this link will take you to a section of the third party’s site which we manage, there are other areas of the site beyond our control. Aside from what is presented specifically on our pages, we do not accept responsibility for products or services offered on this third party’s site nor does Customers Bank necessarily support or condone any opinions or comments expressed or shared on this third party site that are not explicitly our own. Furthermore, as our own privacy policy and security policy are not applicable to this third party, we encourage you to seek out and read their policies.