Banking for entrepreneurs

by entrepreneurs

It's time to experience extraordinary

private business banking service.

Schedule a meeting with your banker today to get started.

Switch me now

A strong and stable bank

Total assets

Total loans and leases

Total liquidity

Non-performing assets ration

Tier 1 Capital

(Customers Bank) Regulatory minimum: 6.0%

Well-capitalized: 8.0%

Basel III Compliant: 8.5%

¹Data as of 12/31/2023, adjusted to account for affiliate and collateralized deposits.

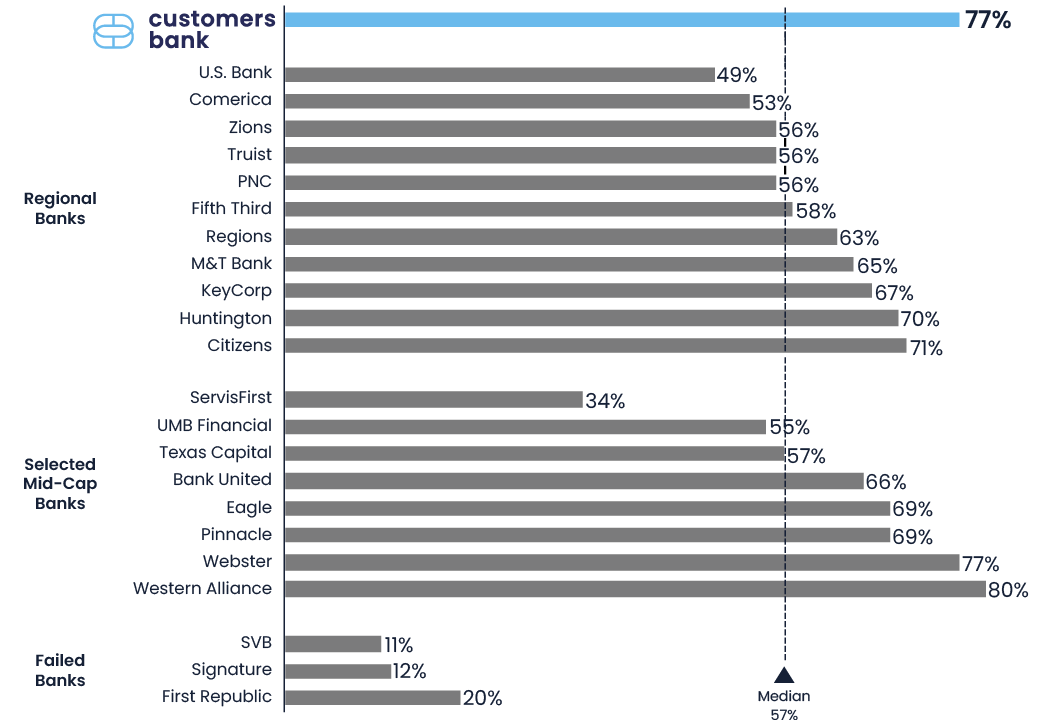

Insured Deposits1 / Total Deposits

Customers Bank’s insured deposits1 as a percentage of total deposits is 77% - in the top three among regional banks and selected mid-cap banks.

Note: Data as of December 31, 2023, except failed banks as of December 31, 2022

1 Insured deposits adjusted to include collateralized and affiliate deposits; similar adjustment made to regional

banks and selected mid-cap banks when publicly disclosed. Otherwise, unadjusted reported figures used.

What makes us different

Customers Bank was founded in 2009 with one main goal in mind: Provide a single-point-of-contact, exceptional banking experience that enables our customers' prosperity.

To achieve this, we rely on a simple, five-step strategy:

Maintain superior credit quality, low interest rate risk and strong liquidity.

Promote solid risk management principles.

Take a customer-first approach.

Tap into our deep industry expertise.

Provide tech-forward products.

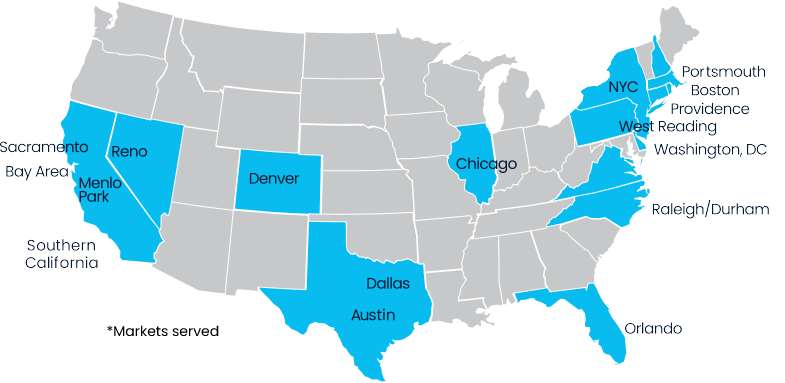

We're expanding.

Credit Ratings

Credit ratings and outlooks are opinions subject to ongoing review by the rating agencies and may change from time to time based on Customers Bank's financial performance, industry dynamic, and other factors.

KBRA Bank Credit Ratings

Ratings as of 5/4/2023- BBB

- BBB-

- K3

- BBB+

- K2

Bauer Financial Ratings

Ratings as of 12/31/23- ★★★★