Power your business with a banker who knows you by name, and Los Angeles by heart.

What makes us different

Customers Bank was founded in 2009 with one goal in mind: to enable our customers’ prosperity.

To achieve this, we rely on three simple principles:

We take a customer-first approach in everything we do. Our growth is intentional, earning relationships by deepening our expertise in service to our customers.

Our Net Promoter Score of 73 is well above the US banking industry average, and many service-first brands across all industries.

We promote solid risk management principles and maintain superior credit quality, low interest rate risk and strong liquidity to endure any economic environment.

We provide best-in-class products and industry-leading service to meet and exceed the needs of our customers.

See how our customers and colleagues are making an impact—in business, in our communities and beyond.

Here to serve Los Angeles.

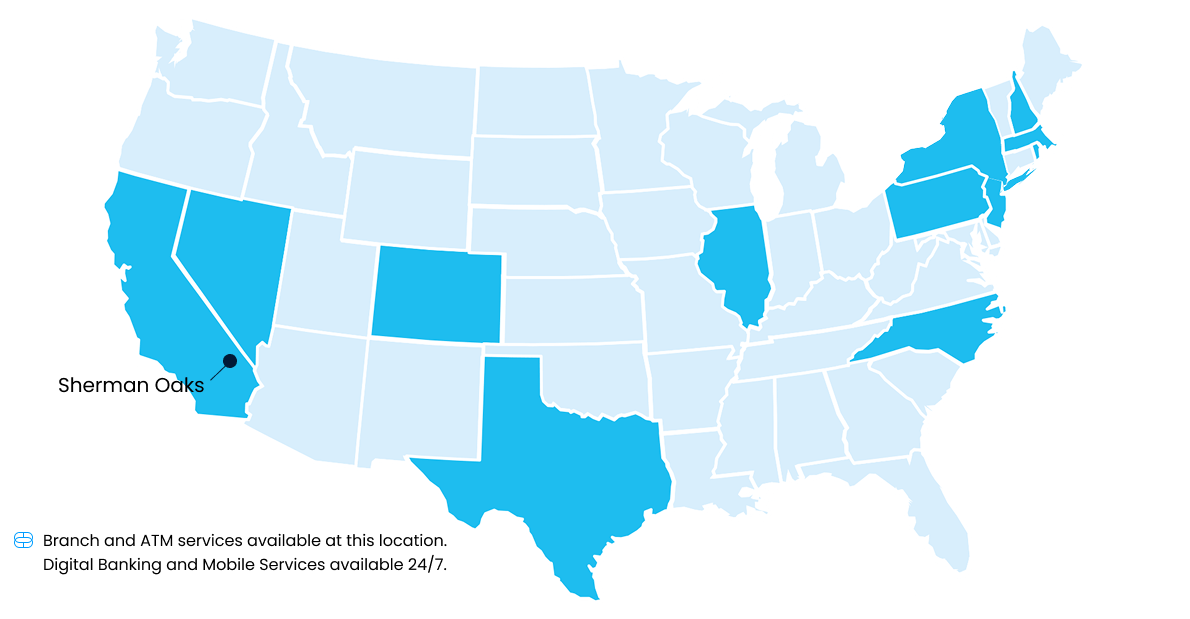

We have team members located in the below states. Regardless of where you are located, with our digitalbanking and mobile services, we bring the bank to you – anytime, anywhere.

California

- Bay Area

- Irvine

- Sacramento

- Sherman Oaks

Colorado

- Denver

Illinois

- Chicago

Massachusetts

- Boston

Nevada

- Las Vegas

- Reno

New Hampshire

- Portsmouth

New Jersey

- Hamilton

New York

- Melville

- New York City

- Rye Brook

North Carolina

- Charlotte

- Durham

Pennsylvania

- Doylestown

- Lancaster

- Langhorne

- Philadelphia

- Phoenixville

- Malvern

- West Reading

- Wyomissing

Rhode Island

- Providence

Texas

- Dallas

Our exceptional service is backed by strength and stability.

Customers Bank is strong and stable, as illustrated by the following key metrics.1

$10.9 billion

Total liquidity

$16.3 billion

Total loans and leases

0.25%

Non-performing assets ratio

$24.3 billion

total assets

Let’s get started.

Complete the form below to connect with a local banker:

1 Data as of 9/30/2025, adjusted to account for affiliate and collateralized deposits.